You lie in bed, the house silent, but your mind is anything but. It’s racing. A chorus of numbers and dates echoes in the dark: the credit card bill due next week, the unexpected car repair, the relentless creep of grocery prices, the student loan balance that seems to shrink at a glacial pace. Your chest feels tight. You check your bank account on your phone for the third time today, the blue light illuminating a face etched with worry. This isn’t just about money; it’s a profound feeling of being trapped, anxious, and alone.

If this feels familiar, you are not alone. In today’s high-cost economy, where inflation outpaces paychecks and financial uncertainty is the new normal, money stress has become a pervasive and debilitating public health issue. But what we often fail to recognize is that this isn’t merely a financial problem—it’s a mental and emotional one.

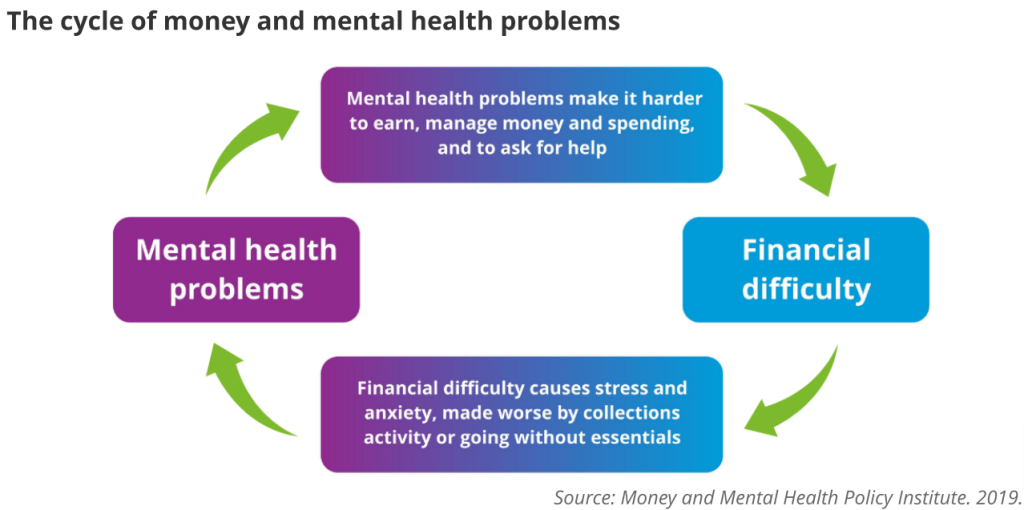

The fundamental premise of this article is that financial wellness is inextricably linked to mental wellness. You cannot have one without the other. The constant strain of financial worry activates the same physiological stress responses as a physical threat, leading to anxiety, depression, sleep disturbances, and relational strife. Conversely, poor mental health can impair the very cognitive functions—like decision-making, impulse control, and future planning—required to manage money effectively.

This article is not a get-rich-quick scheme or a dry, technical manual on budgeting. It is a holistic guide for navigating the psychological toll of money in a challenging economic climate. We will explore the science behind the money-stress connection, provide actionable strategies to regain a sense of control, and discuss how to build financial and mental resilience from the inside out. Our goal is to transform your relationship with money from a source of fear into a tool for empowerment and peace.

Part 1: The Vicious Cycle – Understanding the Money-Mind Connection

To effectively manage money stress, we must first understand its mechanics. The link between our financial situation and our mental state is not just anecdotal; it’s biological and psychological.

The Neuroscience of Financial Stress

When your brain perceives a financial threat—an overdraft fee, a job loss scare, a maxed-out credit card—it triggers the same primal “fight-or-flight” response that kept our ancestors safe from predators. The amygdala, your brain’s alarm system, sounds the alarm. This prompts the release of a cascade of stress hormones, primarily cortisol and adrenaline.

In the short term, this is adaptive. It sharpens your focus. But when financial threats are chronic, as they are for many in a high-cost economy, this system remains permanently activated. Chronically elevated cortisol levels are linked to:

- Anxiety and Depression: The constant state of high alert exhausts the nervous system, leading to feelings of helplessness, irritability, and hopelessness.

- Cognitive Impairment: The prefrontal cortex, responsible for executive functions like planning, decision-making, and impulse control, is effectively “hijacked” by the amygdala. This is why, when you’re stressed about money, you might make impulsive purchases for temporary relief or avoid dealing with your finances altogether—behaviors that worsen the original problem.

- Physical Health Decline: Chronic stress contributes to insomnia, headaches, digestive issues, high blood pressure, and a weakened immune system.

The Psychological Toll of Financial Strain

Beyond the biology, financial stress inflicts deep psychological wounds:

- Shame and Stigma: Society often ties net worth to self-worth. Financial struggle is frequently (and wrongly) internalized as a personal failure, leading to profound shame that prevents people from seeking help or even talking about their struggles.

- Loss of Autonomy and Control: The feeling that you are not in control of your financial life can be one of the most disempowering experiences. It erodes your sense of agency and can make you feel like a passive passenger in your own life.

- Social Withdrawal and Relational Conflict: Money is a leading cause of arguments in relationships. The stress can also lead to social isolation, as you might decline invitations to dinners or events you can’t afford, further compounding feelings of loneliness and depression.

This creates a vicious, self-reinforcing cycle:

Financial Strain → Stress & Anxiety → Poor Financial Decisions (avoidance, impulsivity) → Worsened Financial Strain

Breaking this cycle requires addressing both sides of the equation: the practical financial realities and the psychological burdens they create.

Part 2: The Pillars of Financial Wellness for Mental Peace

Regaining control is the antidote to feeling helpless. Financial wellness is not about being rich; it’s about having clarity, confidence, and a sense of command over your financial life. This involves building a foundation on several key pillars.

Pillar 1: Cultivating Financial Self-Awareness (The “Know Your Numbers” Rule)

You cannot manage what you do not measure. For many, the single greatest source of money anxiety is the unknown. Avoidance fuels fear.

Actionable Steps:

- Conduct a Financial “CAT Scan”: Set aside one hour of undisturbed time. Gather every financial statement—bank accounts, credit cards, loans, investment accounts, bills. Create a simple spreadsheet or use a notebook to document:

- What You Own (Assets): Cash, savings, investment account balances, home equity, etc.

- What You Owe (Liabilities): Total balances on all credit cards, student loans, car loans, mortgages, etc.

- Your Net Worth (Assets – Liabilities): This is your financial snapshot. Don’t be discouraged if it’s negative; this is your baseline for improvement.

- Your Cash Flow: Track every dollar of income and every dollar of spending for one month. Use a budgeting app (like Mint or YNAB) or simply review your bank statements. Categorize your spending (Housing, Food, Transportation, Debt, Entertainment, etc.).

This process can be emotionally challenging, but it is cathartic. It replaces the monster under the bed with a set of concrete, manageable numbers. The anxiety of the unknown is almost always worse than the reality.

Pillar 2: Building a Budget That Breathes (The Anti-Austerity Plan)

The word “budget” often conjures images of deprivation and misery. This is why most budgets fail. A sustainable budget is not a straitjacket; it’s a spending plan that gives you permission to spend on what you value, guilt-free.

Read more: The Benefits of Meditation for Mental Health

Actionable Steps:

- Adopt a Values-Based Framework: Instead of starting with cuts, start with your values. What truly brings you joy and fulfillment? Is it travel? Learning? Time with family? Good food? Align your spending with these values. If you value fitness, a gym membership is a wise investment. If you don’t care about cars, drive a used, reliable model.

- Use the 50/30/20 Rule as a Guideline:

- 50% for Needs: Housing, utilities, groceries, minimum debt payments, essential transportation.

- 30% for Wants: Dining out, hobbies, entertainment, shopping.

- 20% for Savings & Debt Repayment: Emergency fund, retirement, and extra payments on high-interest debt.

- Note: In a high-cost economy, these percentages may need adjustment. The key is the intentionality behind them.

- Embrace Sinking Funds: These are dedicated savings accounts for predictable, non-monthly expenses (e.g., car insurance, holiday gifts, vet bills). Setting aside $50 a month for car repairs is far less stressful than being hit with a $600 bill out of the blue.

Pillar 3: Fortifying Your Financial Defenses (The Emergency Fund)

The emergency fund is the cornerstone of financial and mental security. It is your financial anti-anxiety medication. It transforms a potential crisis (a job loss, a medical emergency, a major repair) into a manageable inconvenience.

Actionable Steps:

- Start Small, But Start: The classic advice of 3-6 months of expenses can feel daunting. Begin with a starter goal of $500 or $1,000. This alone can cover most small emergencies and prevent you from reaching for a credit card.

- Make it Inaccessible: Keep your emergency fund in a separate savings account, ideally at a different bank from your checking account. Out of sight, out of mind—and harder to dip into for non-emergencies.

- Automate It: Set up an automatic transfer from your checking to your emergency savings account every payday, even if it’s only $25. Consistency trumps amount.

Pillar 4: Taming the Debt Dragon (A Strategic Approach)

High-interest debt, particularly from credit cards, is one of the biggest contributors to financial stress. It feels like a weight dragging you underwater. A clear, strategic plan is your lifeline.

Actionable Steps:

- Choose Your Strategy:

- The Debt Avalanche: List your debts from the highest interest rate to the lowest. Pay the minimums on all, and throw every extra dollar at the debt with the highest rate. This is the mathematically optimal method and saves the most on interest.

- The Debt Snowball: List your debts from the smallest balance to the largest. Pay the minimums on all, and focus on paying off the smallest debt first. The psychological win of completely eliminating a debt provides powerful motivation to keep going.

- Consider a Balance Transfer: If you have good credit, transferring high-interest credit card debt to a card with a 0% introductory APR can save you hundreds in interest and accelerate your payoff timeline.

- Communicate with Creditors: If you’re struggling to make payments, be proactive. Call your lenders. Many have hardship programs that can temporarily lower your interest rate or monthly payment.

Part 3: The Mindset Shift: Cognitive and Behavioral Tools for Money Stress

While the practical steps are crucial, they must be supported by a shift in mindset. Managing the emotions of money is just as important as managing the money itself.

1. Practice Financial Mindfulness

Mindfulness is the practice of observing your thoughts and feelings without judgment. Apply this to money.

- Notice Your Triggers: What specific money thoughts cause your heart to race? (“I’ll never get out of debt.” “My friends are so much further ahead.”) Acknowledge the thought without believing it to be an absolute truth.

- Reframe Catastrophic Thinking: When you think, “This is a disaster,” pause and ask, “Is this truly a disaster, or is it a difficult situation I can navigate?” Reframe “I’m bad with money” to “I am developing better money management skills.”

- Implement a “Worry Window”: Schedule 15 minutes each day to actively worry about your finances. Write down all your fears and concerns. When the time is up, and anxious thoughts arise later, tell yourself, “I’ve already addressed that in my worry window, and I don’t need to think about it until tomorrow.”

2. Combat Financial Comparison

In the age of social media, comparing our “behind-the-scenes” to everyone else’s “highlight reel” is a direct path to misery. Remember:

- You Don’t Know Their Reality: That friend with the new car may be drowning in debt. The influencer on a constant vacation may have built a business on a foundation of loans.

- Run Your Own Race: Define what “enough” means for you and your family. Your financial plan is personal. Focus on your progress from where you were last year, not from where someone else is today.

Read more: Mental Health and Chronic Illness: The Connection

3. Develop an Abundance vs. Scarcity Mindset

A scarcity mindset, fueled by fear, focuses on lack and limitation. It leads to hoarding, anxiety, and missed opportunities. An abundance mindset focuses on possibilities, growth, and gratitude.

- Cultivate Gratitude: Regularly take stock of the non-financial riches in your life: your health, relationships, skills, and experiences. This practice neurologically shifts your focus from what you lack to what you have.

- Focus on Earning and Creating: Instead of only thinking about how to cut $5 from your grocery bill, can you brainstorm ways to increase your income by $50? This shifts you from a passive to an active role.

4. Know When to Seek Professional Help

There is no shame in seeking guidance. In fact, it’s a sign of strength and wisdom.

- For Mental Health: If financial stress is causing persistent anxiety, depression, or affecting your daily functioning, a therapist or counselor can provide invaluable tools for coping. Cognitive Behavioral Therapy (CBT) is particularly effective for anxiety-related thought patterns.

- For Financial Health: A accredited, non-commissioned financial planner (look for a fee-only fiduciary) can provide objective advice tailored to your situation. Non-profit credit counseling agencies (like those through the National Foundation for Credit Counseling) can help with debt management plans.

Part 4: Navigating Specific High-Cost Challenges

The current economic landscape presents unique hurdles. Here’s how to apply the principles above to today’s realities.

- Inflation: Revisit your budget. Your 50/30/20 allocation may need temporary adjustment, with more going to “Needs.” Focus on strategic grocery shopping (meal planning, store brands), reduce energy costs, and scrutinize subscription services.

- Housing Costs: If rent or a mortgage is consuming too much of your income, consider creative solutions: getting a roommate, negotiating remote work to move to a lower-cost area, or exploring a house hack (renting out a portion of your home).

- Stagnant Wages: Become your own advocate. Document your accomplishments and research market rates for your role to prepare for a salary negotiation. Simultaneously, invest in upskilling. Explore side hustles that leverage your existing skills or passions.

Conclusion: The Journey to Wholeness

Financial wellness is not a destination marked by a specific net worth; it is a continuous journey of learning, adapting, and growing. It is the profound sense of peace that comes from knowing you have a plan, you are in control, and you are resilient enough to handle life’s inevitable financial curveballs.

By integrating the practical strategies of budgeting, saving, and debt management with the psychological tools of mindfulness, reframing, and self-compassion, you can break the vicious cycle of money stress. You can transform your finances from a source of sleepless nights into a foundation for a secure and fulfilling life.

Remember, every small step you take—whether it’s tracking your spending for one day, transferring $10 to savings, or simply acknowledging a fearful money thought without judgment—is a victory. It is a declaration that your mental well-being is worth fighting for, and that your financial life is a key part of that battle.

Begin today. Take one small action. Your future, less-stressed self will thank you for it.

Frequently Asked Questions (FAQ)

Q1: I feel so overwhelmed and behind. Where do I even start?

Start with the simplest, least intimidating step: Awareness. For one week, commit to not changing your spending, but simply tracking every single penny you spend. No judgment, just observation. This single act of gathering data is the most powerful first step you can take. It moves you from passive worry to active engagement.

Q2: Is it more important to save for an emergency fund or pay down debt?

This is a classic dilemma. The general rule of thumb is to do both in a balanced way. Prioritize a small starter emergency fund ($500-$1,000) first. This prevents you from going further into debt when a small emergency arises. Once that mini-fund is established, you can aggressively focus on paying down high-interest debt. After the debt is under control, go back and build your emergency fund to 3-6 months of expenses.

Q3: How can I talk to my partner about money without it turning into a fight?

- Schedule a “Money Date”: Don’t spring it on them. Set a positive, low-stress time and place.

- Use “I” Statements: Instead of “You spend too much,” try “I feel anxious when we don’t have a clear plan for our finances, and I’d like us to work on one together.”

- Focus on Shared Goals: Start the conversation by dreaming together. “What would we love to do in five years? How can our money help us get there?” This frames money as a tool for your shared life, not a source of conflict.

Q4: I’ve tried budgeting before and always fail. What am I doing wrong?

You’re likely being too restrictive. Most people fail because their budget feels like a punishment. Try a different approach:

- The 80/20 Budget: Automate 20% of your income to savings/debt, and give yourself permission to spend the remaining 80% on whatever you need and want, guilt-free.

- Values-Based Budgeting: As mentioned in the article, ensure your budget funds what you love first, then cut mercilessly from the categories that don’t bring you joy.

Q5: When should I consider seeing a financial therapist?

A financial therapist is a professional who deals with the intersection of money and psychology. Consider seeking one out if:

- Your anxiety about money is preventing you from managing it (e.g., you avoid opening bills).

- Money arguments are causing significant relationship problems.

- You have persistent feelings of shame, guilt, or hopelessness related to your finances.

- You engage in self-sabotaging financial behaviors, like compulsive spending or hoarding, that you can’t control.

Q6: How can I stay motivated when progress feels slow?

Celebrate micro-wins! Paid off a small credit card? That’s a win. Saved your first $100? That’s a win. Stuck to your grocery budget for a week? That’s a win. Track these small victories visually—a chart on your fridge or a list in your journal. Progress, not perfection, is the goal. Remember that building financial wellness is a marathon, not a sprint, and every step forward is a step away from stress.