In the landscape of American anxiety, money is a dominant and relentless feature. It’s the background hum of worry that escalates into a roar when a surprise medical bill arrives, the car breaks down, or the student loan payment reminder pops up. According to the American Psychological Association, finances consistently rank as a top source of stress for a majority of Americans, often eclipsing concerns about work, health, and even politics.

This financial stress is not just a feeling; it’s a physiological and psychological burden. It can manifest as sleep loss, irritability, difficulty concentrating, and even physical symptoms like headaches and high blood pressure. It creates a vicious cycle: stress leads to avoidance, avoidance leads to financial disarray, and disarray leads to even greater stress.

But what if we reframed our approach to money? What if, instead of a source of dread, it could become a tool for security and peace?

This is the heart of financial self-care.

Financial self-care is the practice of proactively and compassionately managing your financial life to reduce anxiety and promote overall well-being. It’s not about getting rich quick or punishing yourself for past mistakes. It’s about building a structured, conscious relationship with your money, so it serves you, rather than controls you.

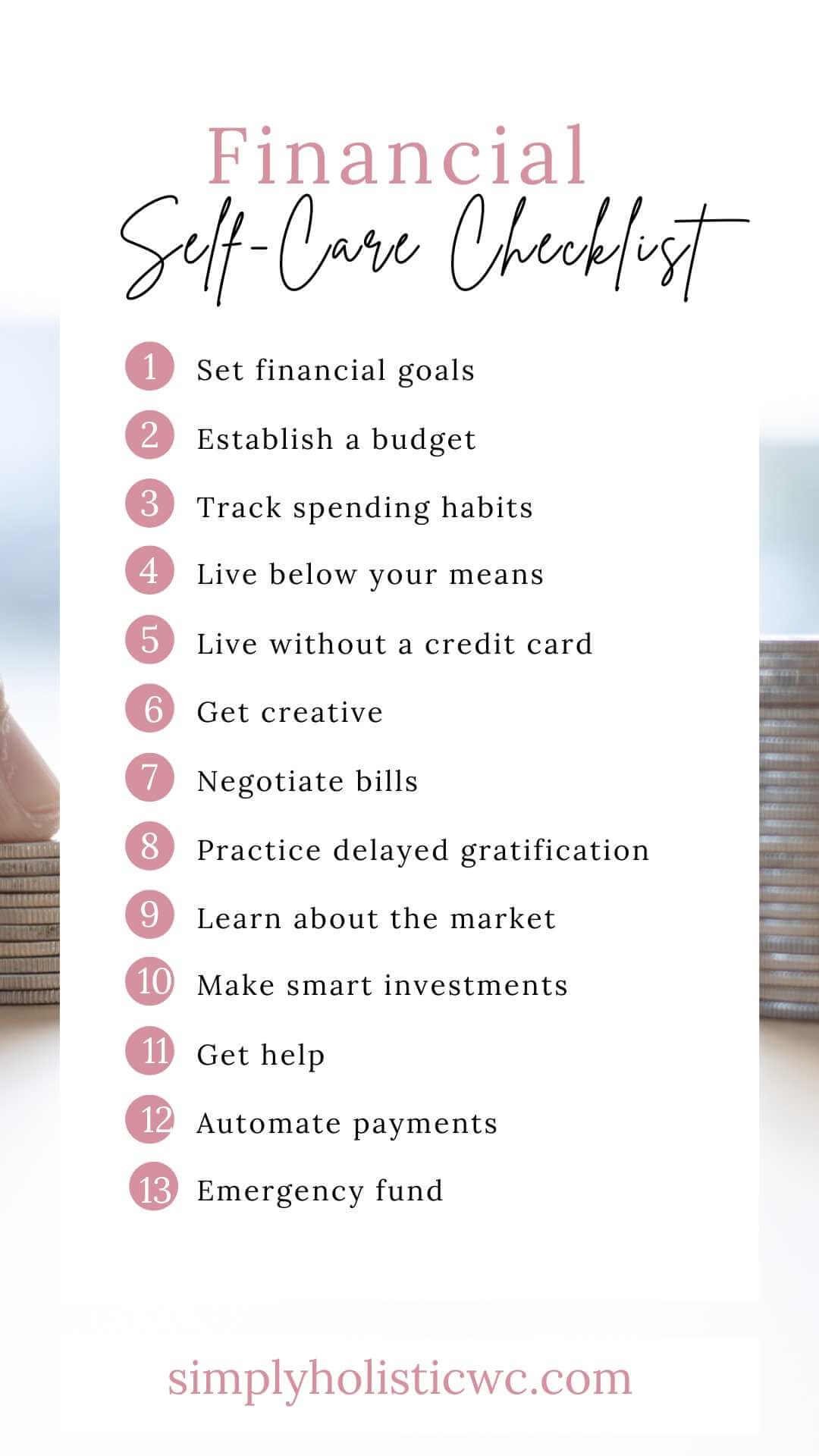

This article provides a comprehensive, step-by-step checklist for practicing financial self-care. This is not a one-size-fits-all budget, but a holistic framework designed to move you from a state of financial fear to a state of financial confidence. By following this checklist, you are not just organizing your finances; you are investing directly in your mental and emotional peace.

Part 1: The Foundation – Mindset Shifts for Financial Well-Being

Before we dive into the numbers, we must address the internal narrative. Your beliefs and emotions about money are the foundation upon which everything else is built.

1. Practice Financial Self-Compassion

The Action: Acknowledge your financial past without judgment.

The “Why”: Shame and guilt are paralyzing. Beating yourself up for past debt or missed savings goals only fuels the cycle of avoidance. Instead, adopt the mindset: “I made the best decisions I could with the knowledge and resources I had at the time. Now, I am learning to do better.” This isn’t about absolving responsibility; it’s about creating a psychologically safe space to begin.

2. Shift from Scarcity to Abundance (Agency)

The Action: Reframe your language from “I can’t afford that” to “That’s not a priority for me right now” or “I’m choosing to allocate my money elsewhere.”

The “Why”: The phrase “I can’t” evokes powerlessness. “I choose” evokes agency and control. This subtle shift reminds you that you are the active manager of your money, not its passive victim. An abundance mindset isn’t about pretending you have limitless funds; it’s about recognizing the power and potential in the resources you do have.

3. Define Your “Why”

The Action: Write down your core financial values. What does money enable for you? Is it security? Freedom? The ability to provide for your family? The opportunity for experiences? Philanthropy?

The “Why”: Budgets based solely on restriction are destined to fail. When your financial plan is connected to your deepest values, it becomes a meaningful mission, not a punitive chore. Your “why” is the fuel that will keep you motivated when the going gets tough.

Part 2: The Financial Self-Care Checklist

This checklist is divided into four key phases. You do not need to complete them all in one day. Tackle one phase at a time, celebrating small wins along the way.

Phase 1: The Financial Triage & Awareness Audit

The goal of this phase is to move from avoidance to awareness. You cannot fix what you don’t understand.

Checklist Item 1: The Financial “Open Enrollment”

- Action: Gather every single financial document in one place. This includes bank statements (checking/savings), credit card statements, investment accounts, loan statements (student, auto, personal), pay stubs, and bills.

- Tool: A filing folder, a shoebox, or a dedicated digital folder on your computer.

- Mindset Tip: This is a fact-finding mission, not a judgment day. You are a detective gathering evidence.

Checklist Item 2: Calculate Your Net Worth

- Action: List all your Assets (what you own: savings account balances, investment portfolio value, estimated home/vehicle value). Then list all your Liabilities (what you owe: total credit card debt, loan balances, mortgage balance). Your Net Worth = Total Assets – Total Liabilities.

- Tool: A simple spreadsheet or a pen and paper.

- Mindset Tip: Your net worth is a snapshot in time, not a scorecard of your worth as a human. This number is your baseline; the goal is to see it grow over time.

Checklist Item 3: Track Your Cash Flow

- Action: For one full month, track every single dollar that comes in and goes out. Categorize every expense (e.g., Housing, Transportation, Groceries, Dining Out, Subscriptions, Healthcare).

- Tool: Use a budgeting app (like Mint, YNAB “You Need A Budget”, or Rocket Money), a spreadsheet, or a simple notebook.

- Mindset Tip: The goal here is curiosity, not criticism. You are discovering your money’s story—where it actually goes, not where you think it goes.

Checklist Item 4: Check Your Credit Report

- Action: Obtain your free annual credit report from AnnualCreditReport.com. Review it for errors or signs of fraud.

- Tool: AnnualCreditReport.com (the only officially authorized site for free reports).

- Mindset Tip: Your credit report is a financial resume. Keeping it accurate and healthy is a key part of self-care, as it affects your ability to secure loans, rent apartments, and sometimes even get jobs.

Phase 2: The Defense & Stability Building Phase

With awareness established, the goal now is to build a foundation of security to protect yourself from life’s inevitable surprises.

Read more: Why Holistic Health is Gaining Popularity Among Americans

Checklist Item 5: Create a Simple, Guilt-Free Spending Plan

- Action: Using your cash flow data, create a realistic budget. A great method is the 50/30/20 rule as a starting point:

- 50% of your take-home pay to Needs (housing, utilities, groceries, minimum debt payments).

- 30% to Wants (dining, entertainment, shopping).

- 20% to Savings & Debt Repayment (this is for extra debt payments and savings).

- Tool: Budgeting app or spreadsheet.

- Mindset Tip: If your numbers don’t fit this mold, that’s okay! Adjust the percentages. The goal is a plan you can stick to, not a perfect theoretical model.

Checklist Item 6: Build Your “Peace of Mind” Fund

- Action: Start an emergency fund. The initial goal is $500-$1,000. The ultimate goal is 3-6 months’ worth of essential living expenses.

- Tool: Open a separate, high-yield savings account at a different bank from your checking account to make it less tempting to access.

- Mindset Tip: This fund is not for vacations or gifts. It is self-care insurance for your future self. Every dollar in this fund directly reduces financial anxiety.

Checklist Item 7: Automate Your Financial Health

- Action: Set up automatic transfers for your savings and bill payments.

- Automatically transfer money to your emergency fund and/or investment accounts right after you get paid.

- Automate all minimum payments on bills and debt to avoid late fees and credit damage.

- Tool: Your online banking portal.

- Mindset Tip: Automation is the ultimate form of financial self-care. It makes positive financial behaviors effortless and ensures you pay yourself first.

Phase 3: The Offense & Future-Building Phase

Once you have a stable foundation, you can start building toward your future goals.

Checklist Item 8: Tackle Debt Strategically

- Action: Choose a debt repayment strategy.

- Avalanche Method: List debts by interest rate (highest to lowest). Pay minimums on all, and put any extra money toward the debt with the highest interest rate. (Saves the most money on interest).

- Snowball Method: List debts by balance (smallest to largest). Pay minimums on all, and put any extra money toward the smallest balance. (Provides quick psychological wins and builds momentum).

- Tool: A debt tracking spreadsheet or an app like Undebt.it.

- Mindset Tip: Celebrate every debt you pay off! This is a marathon, not a sprint. Acknowledging progress is crucial for motivation.

Checklist Item 9: Secure Your Future Self

- Action:

- If your employer offers a 401(k) match, contribute at least enough to get the full match. It’s free money and the best return on investment you’ll ever get.

- Open and contribute to an IRA (Individual Retirement Account).

- Ensure you have adequate insurance: health, renters/homeowners, and auto.

- Tool: Your HR department for 401(k) info; online brokerages like Vanguard, Fidelity, or Charles Schwab for IRAs.

- Mindset Tip: Retirement savings is not a luxury. It is today’s self-care for your future self, ensuring your later years are spent in security, not scarcity.

Checklist Item 10: Align Spending with Values

- Action: Review your budget from Phase 1. Are your spending categories aligned with the “Why” you defined in Part 1? Can you reduce spending in low-value areas to free up money for high-value goals?

- Tool: Your budget and your values list.

- Mindset Tip: This is where financial management becomes financial empowerment. You are consciously designing your life by directing your money toward what truly brings you joy and fulfillment.

Phase 4: The Maintenance & Growth Phase

Financial self-care is a lifelong practice, not a one-time project.

Checklist Item 11: Schedule a Weekly “Money Date”

- Action: Block out 30 minutes each week to review your finances. Check your accounts, update your budget, and track progress toward your goals.

- Tool: Your calendar.

- Mindset Tip: This habit transforms money management from a sporadic, stressful event into a calm, routine maintenance task. It keeps you in control and prevents small issues from becoming big problems.

Read more: Using Herbs for Natural Healing

Checklist Item 12: Conduct an Annual Financial Review

- Action: Once a year, go through this entire checklist again. Re-calculate your net worth, reassess your budget, review your insurance coverage, and re-evaluate your financial goals.

- Tool: This checklist.

- Mindset Tip: This is your annual financial physical. It ensures your plan still fits your life and allows you to celebrate the progress you’ve made over the past year.

Part 3: Tailoring Your Financial Self-Care Plan

Your financial life is unique. Here’s how to adapt the checklist to common life situations.

For the Debt-Burdened:

- Focus: Phase 1 (Awareness) and Phase 2 (Stability).

- Priority: In your 50/30/20 budget, the “20” for savings/debt might initially be a “5” for a tiny emergency fund and a “15” for aggressive debt repayment. The goal is to build a small buffer ($1,000) to avoid new debt, then attack the existing debt with intensity.

For the Financially Avoidant:

- Focus: Phase 1, Item 1 only. Just gather the documents. That’s the win for the week.

- Priority: Break everything down into micro-tasks. “Today, I will log into my checking account and just look at the balance.” Pair the task with a reward—a favorite coffee, a walk—to create a positive association.

For Couples:

- Focus: All phases, but with an emphasis on communication.

- Priority: Schedule a monthly “Financial Summit” to discuss goals, concerns, and the budget together. Frame it as a team working toward shared dreams, not a blame session.

For Freelancers & Gig Workers:

- Focus: Phase 2 (Stability) is paramount.

- Priority: Given variable income, your emergency fund should be on the higher end (6+ months of expenses). Use a “tiered” budgeting system where you cover needs first, then savings, then wants, based on each payment you receive.

Conclusion: Your Financial Peace is a Practice

Financial self-care is a journey, not a destination. It is the cumulative effect of small, consistent, and compassionate actions. There will be setbacks and surprises—a flat tire, a market downturn, a unexpected life event. The goal is not to create a perfect, unassailable financial fortress, but to build the resilience and systems to handle these events without spiraling into panic.

By working through this checklist, you are doing more than just balancing a budget. You are building a relationship with your money based on trust and competence, rather than fear. You are replacing the heavy weight of financial anxiety with the light, empowering feeling of being in control.

Start today. Pick one item—just one—from the checklist and complete it. That single act is a powerful declaration that your financial peace of mind matters. Your future, less-stressed self will thank you for it.

Frequently Asked Questions (FAQ)

Q1: I feel completely overwhelmed and don’t know where to start. What is the absolute first step?

A: The very first step is the simplest: Practice financial self-compassion. Say out loud, “My financial situation is what it is. I am now taking the first step to improve it.” Then, move to Checklist Item 1: The Financial ‘Open Enrollment.’ Don’t even analyze the documents—just gather them in one place. This single act of confronting the unknown is the most powerful step you can take.

Q2: I’m living paycheck to paycheck. How can I possibly save for an emergency fund?

A: This is a common and difficult situation. The strategy here is to start microscopically.

- Automate Tiny Amounts: Set up an automatic transfer of $5 or $10 per week to a savings account. You likely won’t miss it, but it builds the habit and the account balance.

- The “No-Spend” Challenge: Pick a category (e.g., eating out, coffee shops) and commit to a one-week “no-spend” challenge in that category. Direct every dollar saved straight to your emergency fund.

- “Found” Money: Immediately deposit any windfalls—tax refunds, birthday money, rebates, side hustle income—into your emergency fund. The goal is to get that initial $500 buffer as quickly as possible.

Q3: What’s the difference between a budget and a spending plan? And which is better?

A: Semantically, they are similar. However, psychologically, they feel very different.

- A “Budget” often carries connotations of restriction, deprivation, and complexity. It feels like a straitjacket.

- A “Spending Plan” frames your money as a tool to be allocated intentionally. It’s proactive and empowering. It answers the question, “What do I want my money to do for me this month?”

For most people, shifting their mindset to a “spending plan” makes the process feel more positive and sustainable.

Q4: Should I pay off debt or save for retirement first?

A: This is a classic dilemma. Follow this hierarchy:

- Essential Minimums: Always pay the minimums on all your debts to avoid penalties.

- Get the 401(k) Match: If you have a employer match, contribute enough to get the full match. This is an instant 50-100% return on your money, which almost certainly outweighs the interest you’re paying on debt.

- Build a Mini Emergency Fund ($1,000): This prevents you from going deeper into debt when an unexpected expense arises.

- Aggressively Pay Off High-Interest Debt: Focus on credit card and personal loan debt with interest rates above 7-8%.

- Maximize Retirement and Other Goals: Once high-interest debt is gone, you can ramp up retirement savings and tackle lower-interest debt (like some student loans or mortgages).

Q5: How can I talk to my partner about money without it turning into an argument?

A: Structure the conversation for success.

- Set a Time: Don’t spring it on them. Schedule a “money date” in a neutral, public place like a coffee shop.

- Use “I” Statements: Focus on your feelings and goals. “I feel anxious about our savings,” not “You never save any money.”

- Start with Dreams: Begin the conversation by discussing your shared dreams (a vacation, a home, financial independence). This puts you on the same team, working toward a common goal.

- Consider a “Third Space”: Using a budgeting app that you both share can serve as a neutral “third space” to view your finances objectively, reducing blame.

Q6: I’m afraid of looking at my financial situation. What if it’s worse than I think?

A: The fear of the unknown is almost always worse than the reality. The numbers on the page are just information. They have no moral value. Not knowing the number doesn’t make the problem go away; it just gives it power over you. By looking at it, you are taking its power away. You are transforming a nebulous monster of fear into a set of concrete problems that can be solved, one step at a time. Remember, you are gathering data, not passing judgment.